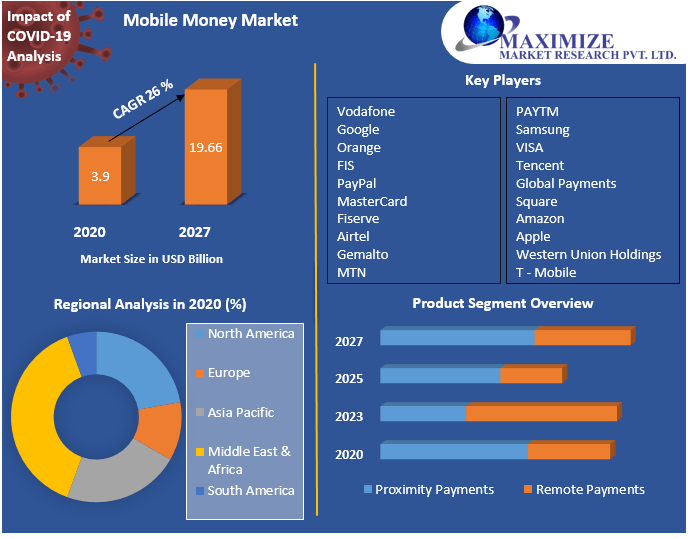

Mobile Money Market size was valued at US$ 3.9 Bn. in 2020 and the total revenue is expected to grow at 26 % through 2021 to 2027, reaching nearly US$ 19.66 Bn.

Mobile Money Market research report offers a comprehensive analysis of the market outlook for 2022–2029, including the fastest-growing countries, industries, market sizes and shares, and growth requirements. A comprehensive overview of market size, share, trends, and industry features are provided in the Global Mobile Money Market Report with regard to all geographical regions. The report outlines the market's size, share, growth prospects, obstacles, stage of development, and the leading players' most recent growth strategies (sales value and volume, company profiles, and competitors). Defining distinct industry prospects, manufacturing cost structure, gross margin, the study of price trends, upstream and downstream analysis using SWOT and Porter's Five Forces analysis, and more.

Get a sample PDF of the Report at :https://www.maximizemarketresearch.com/request-sample/7166

Mobile Money Market Key players:

• Google

• Orange

• FIS

• PayPal

• MasterCard

• Fiserve

• Airtel

• Gemalto

• Alipay

• MTN

• PAYTM

• Samsung

• VISA

• Tencent

• Global Payments

The market size, segment size (mostly covering geography and segmentation), competitive environment, current situation, and development trends are the key topics of the report. A comprehensive examination of the supply chain and costs is also provided in the study. The product's performance will be further improved through technological innovation and progress, increasing its use in downstream applications. Studies on consumer behavior and market dynamics (drivers, restrictions, opportunities) also offer crucial information for comprehending the Mobile Money market.

Mobile Money Market size was valued at US$ 3.9 Bn. in 2020 and the total revenue is expected to grow at 26 % through 2021 to 2027, reaching nearly US$ 19.66 Bn.

Mobile Money Market Dynamics:

The increase in the number of mobile phones user is driving the growth of the Mobile Money Market. The increasing number of mobile subscribers signifies an increasing potential for monetary transactions using mobile phones driving the growth at an exponential rate.

For online financial service providers, mobile money systems can provide a gateway to tap large unexplored market avenues as most of the population is yet to adopt this technology. By developing digital financial capabilities, companies can open themselves up to other submarkets like micropayments, data-based financial services, and potential digital markets.

The rise in the efficiency of mobile money transactions has led to an increase in overall spending which has encouraged companies to work towards developing this technology. The use of transaction modes like NFC/smart cards has sped up the process of transactions. People everywhere are increasingly adopting mobile banking services which ensure high transactional security. The development of e-commerce websites has also contributed to an increase in the number of online transactions which has driven the Mobile Money Market.

Mobile Money Market Segmentation:

By Payment Type, proximity payments dominated the market in 2020 with a 57% share. Mobile phones and point-of-sale devices are used for proximity payments. Many companies now offer applications that enable proximity payments. For short distances and work, proximity payments are specially activated if both the payer and the payee are in the same location.

This payment system initiates mobile money transactions using either barcodes or contactless interfaces. This is done using Near Field Communication (NFC) based technology. It contains comprehensive details about mobile wallets that are present on NFC-enabled phones and are stored in the cloud or on debit / credit cards. The increasing acceptance of mobile payment technology by fixed businesses is driving the demand for proximity payments.

The global Mobile Money market report offers important data on the condition of the sector and is a useful resource for businesses and people who are interested in the market. Marketing channels and industry trends are examined in Computer Graphics. Finally, the viability of new investment initiatives is evaluated, and general study findings are presented.

Regional Analysis:

Talk with our Research Analyst:https://www.maximizemarketresearch.com/request-sample/7166

Key points of Mobile Money market report:

Contact us:

MAXIMIZE MARKET RESEARCH PVT. LTD.

3rd Floor, Navale IT Park Phase 2,

Pune Banglore Highway,

Narhe, Pune, Maharashtra 411041, India.

Maximize Market Research provides B2B and B2C research on 12,500 high growth emerging opportunities & technologies as well as threats to the companies across the Healthcare, Pharmaceuticals, Electronics & Communications, Internet of Things, Food and Bever

Mobile Money Market , Mobile Money Market size , Mobile Money Market Research , Mobile Money Market trend , Mobile Money Market Forecast

Nov 25, 2022