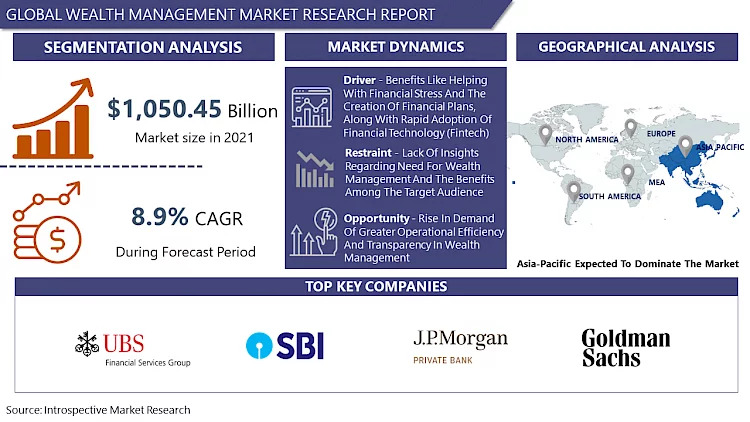

Global Wealth Management Market size was valued at USD 1,143.94 Billion in 2022 and is projected to reach USD 2,262.70 Billion by 2030, growing at a CAGR of 8.9% during the forecast period.

Global Wealth Management Market size was valued at USD 1,143.94 Billion in 2022 and is projected to reach USD 2,262.70 Billion by 2030, growing at a CAGR of 8.9% during the forecast period.

Financial services catering to high net worth individuals and institutional clients are included in the wealth management sector. The primary focus of these services is asset management, financial planning, and thorough investment advice. Professionals in wealth management help customers achieve long-term financial objectives, manage risks, and optimize their financial portfolios. Retirement planning, tax preparation, estate planning, and investment management are a few examples of services. The market serves wealthy customers looking for strategic and individualized financial advice. To provide specialized solutions, wealth management companies and advisors draw on their knowledge of financial products, market trends, and investment methods. In order to protect and increase the wealth of people and organizations and to help them make wise financial decisions, the wealth management industry plays a significant role.

Top Key Players Covered In the Wealth Management Market

UBS Group AG (Switzerland), Morgan Stanley Wealth Management (USA), SBERBANK (Russia), Credit Suisse (Switzerland), State Bank of India (India), Bank of America Global Wealth and Investment Management (USA), J.P. Morgan Private Bank (USA), Citi Private Bank (USA), BNP Paribas Wealth Management (France), Goldman Sachs (USA), Charles Schwab (USA) and Other Key Players

Discount on the Research Report@

https://introspectivemarketresearch.com/discount/16511

Focused on offering high-net-worth individuals (HNWIs) and institutional clients full financial advice and investment services, the wealth management market is a dynamic sector within the financial services industry. Financial planning, risk management, estate planning, and investment advisory are just a few of the activities that go under the umbrella of wealth management. The market is driven by the growing need for specialized and sophisticated financial solutions, the complexity of financial markets, and the increasing accumulation of wealth around the globe. To assist customers in managing and growing their wealth while navigating challenging financial environments, wealth management organizations make use of technology, data analytics, and advisory skills.

Customize Your Solution That Fit Within the Constraints of Your Annual Budget.!

https://introspectivemarketresearch.com/request/16511

The growing number of high-net-worth individuals and the increasing concentration of wealth are major factors driving the wealth management market. Financial markets and global economies are expanding, causing people and institutions to amass significant wealth that needs to be managed strategically. The demand for professional wealth management services is driven by legislative changes, tax considerations, and the complexity of investment possibilities.

A major driver is also the ongoing demographic transformation, which includes the generational transfer of wealth. In order to help clients with succession planning, intergenerational asset transfer, and maintaining and increasing family wealth, wealth management companies are essential.

Segmentation of The Wealth Management Market:

By Service

By Advisory Type

By Provider

By End User

The integration of digital technology and fintech solutions into wealth management services presents a significant business opportunity. The emergence of robo-advisors, mobile applications, and online platforms offers wealth management companies a chance to improve customer satisfaction, optimize internal processes, and provide more affordable and easily accessible solutions. Adopting technology advancements might provide you a competitive edge in the market and draw in a wider clientele, especially younger investors.

Furthermore, there is increasing potential in broadening services to include environmental, social, and governance (ESG) investing. There is a growing demand on wealth management companies to include ESG factors in their investment strategies due to the increased awareness of sustainable and responsible investing. Businesses that proactively match their offerings to socially conscious investment trends can draw in customers who have an inclination toward environmentally friendly wealth management techniques.

Your Customization, Your Satisfaction - Contact Us!

https://introspectivemarketresearch.com/custom-research/16511

By Region

Our Free Sample Report Includes:

No Worries, Just Orders - Secure Yours Today!

https://introspectivemarketresearch.com/checkout/?user=1&_sid=16511

About us:

Introspective Market Research (introspectivemarketresearch.com) is a visionary research consulting firm dedicated to assist our clients grow and have a successful impact on the market. Our team at IMR is ready to assist our clients flourish their business by offering strategies to gain success and monopoly in their respective fields. We are a global market research company, specialized in using big data and advanced analytics to show the bigger picture of the market trends.

We help our clients to think differently and build better tomorrow for all of us. We are a technology-driven research company, we analyze extremely large sets of data to discover deeper insights and provide conclusive consulting. We not only provide intelligence solutions, but we help our clients in how they can achieve their goals.

Contact us:

Introspective Market Research

3001 S King Drive,

Chicago, Illinois

60616 USA

Ph no: +1 773 382 1049

Introspective Market Research (introspectivemarketresearch.com) is a visionary research consulting firm dedicated to assist our clients grow and have a successful impact on the market.

Wealth Management Market Size , Wealth Management Market Share , Wealth Management Market Growth , Wealth Management Market Trend , Wealth Management Market segment , Wealth Management Market Opportunity , Wealth Management Market Analysis 2023 , US Wealth

Dec 21, 2023